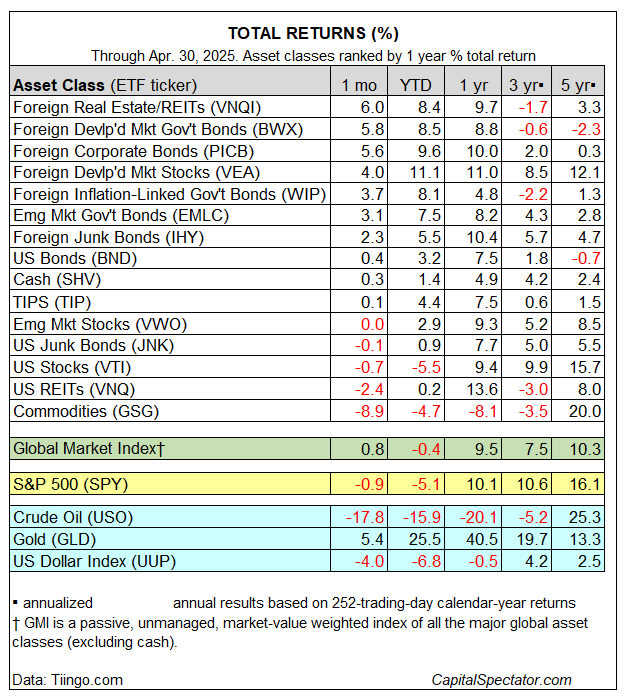

Foreign markets continued to rally in March, leading returns for the major asset classes and extending a bullish trend for foreign assets in 2025, based on a set of ETFs. US stocks, US junk bonds, and US property shares, by contrast, continued to lose ground. The big loser in March: commodities, which posted an unusually steep decline.

Foreign real estate shares ( VNQI ) led the winners in March, surging 6.0%. The strong gain marks the fourth straight monthly advance for the ETF.

Foreign stocks and bonds also posted hefty gains last month, including a 5.8% rally in government bonds in developed markets ex-US ( BWX ).

Commodities (GSG) crashed 8.9% in March, the biggest monthly decline since the pandemic shock in March 2020.

Year to date, most of the major asset classes are still posting gains. The two downside exceptions: US stocks (

VTI

) and commodities (

GSG

).

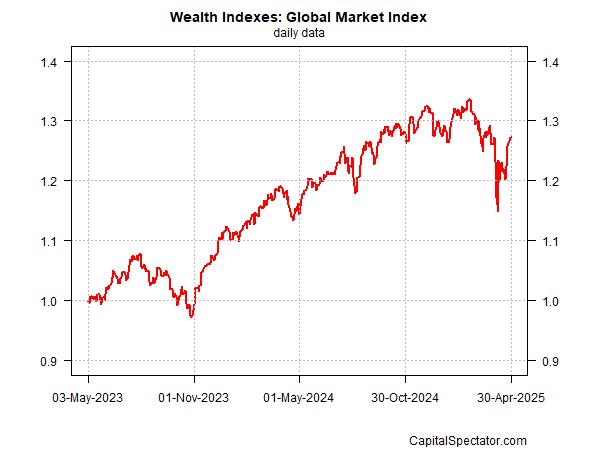

The Global Market Index (GMI) rebounded in March, rising 0.8%–the first monthly advance since January. GMI’s year-to-date loss was pared to a modest 0.4% decline.

GMI is an unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolio strategies.